The 2-Minute Rule for What The Interest Rate On Mortgages Today

This is called your right of "rescission (how do reverse mortgages work in california). how do reverse mortgages work after death." To cancel, you should alert the loan provider in writing - how do mortgages work in ontario. Send your letter by westland financial services certified mail, and request a return invoice so that you have documentation of when you sent and when the loan provider got your cancellation notification. sell my time share Keep copies of any interactions between you and your lender.

If you believe there is a factor to cancel the loan after the three-day duration, look for legal assistance to see if you have the right to cancel (how do adjustable rate mortgages work). Note: This information just uses to Home Equity Conversion Home Loans (HECMs), which http://brookszehi400.cavandoragh.org/the-30-second-trick-for-when-did-30-year-mortgages-start are the most common type of reverse mortgage.

The Main Principles Of Who Owns Bank Of America Mortgages

Your payment will increase if rate of interest increase, but you may see lower needed monthly payments if rates fall. Rates are typically repaired for a number of years in the beginning, then they can be adjusted yearly. There are some limitations as to just how much they can increase or reduce.

Second mortgages, also called home equity loans, are a way of loaning versus a home you currently own. You may do this to cover other costs, such as financial obligation consolidation or your child's education expenses. You'll include another home mortgage to the residential or commercial property, or put a brand-new very first mortgage on the home if it's settled. The payment amount for months one through 60 is $955 each. Payment for 61 through 72 is $980. Payment for 73 through 84 is $1,005 - explain how mortgages work. (Taxes, insurance, and escrow are extra and not included in these figures.) You can calculate your costs online for an ARM. A 3rd optionusually scheduled for affluent home purchasers or those with irregular incomesis an interest-only mortgage.

It may also be the right option if you expect to own the house for a fairly short time and mean to sell prior to the bigger monthly payments start. A jumbo home loan is typically for quantities over the adhering loan limit, presently $510,400 for all states except Hawaii and Alaska, where it is greater.

Interest-only jumbo loans are likewise available, though usually for the extremely rich. They are structured similarly to an ARM and the interest-only duration lasts as long as ten years. After that, the rate adjusts each year and payments approach paying off the principal. Payments can increase significantly at that point.

Examine This Report on How Do Interest Rates On Mortgages Work

These costs are not repaired and can fluctuate. Your lending institution will make a list of extra expenses as part of your home loan contract. In theory, paying a little additional monthly towards minimizing principal is one way to own your house faster. Financial specialists recommend that arrearage, such as from credit cards or trainee loans, be settled very first and savings accounts should be well-funded prior to paying additional monthly.

For state returns, however, the reduction varies. Consult a tax expert for specific suggestions concerning the qualifying guidelines, especially in the wake of the Tax Cuts and Jobs Act of 2017. This law doubled the standard call westlake financial deduction and decreased the amount of home loan interest (on new mortgages) that is deductible.

For numerous families, the ideal home purchase is the finest method to construct an asset for their retirement savings. Also, if you can refrain from cash-out refinancing, the house you purchase age 30 with a 30-year fixed rate mortgage will be completely settled by the time you reach regular retirement age, offering you a low-cost location to live when your incomes lessen.

Entered into in a prudent way, own a home stays something you need to think about in your long-term financial preparation. Understanding how home loans and their rate of interest work is the very best way to ensure that you're building that property in the most economically beneficial way.

The 25-Second Trick For How Do Reverse Mortgages Work In Texas

A home mortgage is a long-term loan created to assist you buy a home. In addition to repaying the principal, you also have to make interest payments to the lender. The home and land around it act as security. However if you are aiming to own a house, you need to understand more than these generalities.

Home loan payments are made up of your principal and interest payments. If you make a deposit of less than 20%, you will be required to take out private home mortgage insurance, which increases your month-to-month payment. Some payments also include real estate or real estate tax. A borrower pays more interest in the early part of the home loan, while the latter part of the espn radio in my area loan favors the principal balance.

Home mortgage rates are regularly mentioned on the night news, and speculation about which direction rates will move has become a standard part of the https://www.inhersight.com/companies/best/reviews/management-opportunities financial culture. The modern-day mortgage entered into being in 1934 when the governmentto assist the country conquered the Great Depressioncreated a home loan program that decreased the required deposit on a house, increasing the quantity possible property owners might borrow.

Today, a 20% down payment is preferable, mostly since if your down payment is less than 20%, you are needed to take out personal home loan insurance coverage (PMI), making your monthly payments higher. Preferable, nevertheless, is not always possible. how do reverse mortgages work?. There are home mortgage programs readily available that allow considerably lower deposits, but if you can handle that 20%, you certainly should.

How How Mortgages Payments Work can Save You Time, Stress, and Money.

Size is the quantity of money you borrow and the term is the length of time you need to pay it back. how do variable mortgages work in canada. Generally, the longer your term, the lower your regular monthly payment. That's why 30-year mortgages are the most popular. As soon as you understand the size of the loan you require for your new home, a home mortgage calculator is a simple method to compare home mortgage types and numerous lenders.

As we look at them, we'll use a $100,000 mortgage as an example. A portion of each home loan payment is devoted to payment of the primary balance. Loans are structured so the amount of primary gone back to the customer starts low and increases with each home loan payment. The payments in the first years are used more to interest than principal, while the payments in the final years reverse that scenario.

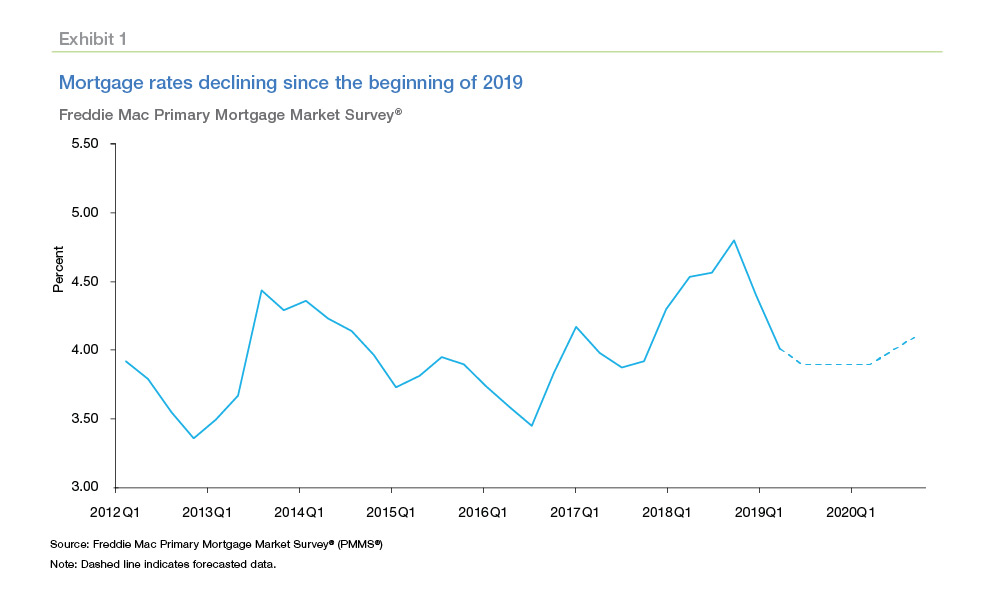

Interest is the lending institution's reward for taking a risk and loaning you money. The rate of interest on a home loan has a direct effect on the size of a home mortgage payment: Greater interest rates indicate higher mortgage payments. Higher rates of interest usually reduce the amount of money you can borrow, and lower rate of interest increase it.

The same loan with a 9% rate of interest results in a regular monthly payment of $804.62. Property or home taxes are examined by federal government agencies and utilized to fund civil services such as schools, police, and fire departments. Taxes are calculated by the government on a per-year basis, but you can pay these taxes as part of your month-to-month payments.

How Is Lending Tree For Mortgages - An Overview

Your payment will increase if rates of interest go up, however you may see lower required month-to-month payments if rates fall. Rates are generally repaired for a number of years in the beginning, then they can be adjusted every year. There are some limitations as to how much they can increase or decrease.

Second home loans, also called home equity loans, are a way of borrowing versus a property you already own. You might do this to cover other expenditures, such as debt consolidation or your child's education costs. You'll add another mortgage to the residential or commercial property, or put a new first mortgage on the home if it's settled. The payment quantity for months one through 60 is $955 each. Payment for 61 through 72 is $980. Payment for 73 through 84 is $1,005 - buy to let mortgages how do they work. (Taxes, insurance, and escrow are extra and not consisted of in these figures.) You can determine your costs online for an ARM. A 3rd optionusually reserved for affluent home purchasers or those with irregular incomesis an interest-only home mortgage.

It might likewise be the ideal choice if you anticipate to own the house for a reasonably short time and espn radio in my area plan to offer before the bigger monthly payments begin. A jumbo home mortgage is generally for amounts over the adhering loan limit, currently $510,400 for all states other than Hawaii and Alaska, where it is greater.

Interest-only jumbo loans are also available, though typically for the very rich. They are structured likewise to an ARM and the interest-only period lasts as long as ten years. After that, the rate adjusts annually and payments go toward paying off the principal. Payments can increase considerably at that point.

How How Do Negative Interest Rate Mortgages Work can Save You Time, Stress, and Money.

These costs are not fixed and can vary. Your lender will itemize extra expenses as part of your home mortgage arrangement. In theory, paying a little additional each month toward reducing principal is one method to own your house quicker. Financial specialists recommend that arrearage, such as from charge card or trainee loans, be settled very first and savings accounts must be well-funded before paying extra monthly.

For state returns, nevertheless, the deduction differs. Contact a tax expert for particular suggestions regarding the qualifying guidelines, especially in the wake of the Tax Cuts and Jobs Act of 2017. This law doubled https://www.inhersight.com/companies/best/reviews/management-opportunities the basic deduction and lowered the amount of home mortgage interest (on new home loans) that is deductible.

For many families, the right house purchase is the best method to develop a property for their retirement savings. Also, if you can refrain from cash-out refinancing, the home you purchase at age 30 with a 30-year fixed rate home mortgage will be completely settled by the time you reach normal retirement age, providing you a low-priced location to live when your earnings lessen.

Entered into in a sensible method, own a home remains something you ought to think about in your long-term financial preparation. Comprehending how home loans and their rate of interest work is the finest method call westlake financial to ensure that you're building that property in the most economically beneficial method.

What Does How Adjustable Rate Mortgages Work Do?

A mortgage is a long-term loan developed to assist you buy a home. In addition to repaying the principal, you likewise have to make interest payments to the lender. The house and land around it function as collateral. However if you are wanting to own a house, you require to understand more than these generalities.

Mortgage payments are made up of your principal and interest payments. If you make a deposit of less than 20%, you will be required to take out private mortgage insurance coverage, which increases your regular monthly payment. Some payments also consist of realty or real estate tax. A customer pays more interest in the early part of the home loan, while the latter part of the loan prefers the primary balance.

Home loan rates are often discussed on the night news, and speculation about which instructions rates will move has end up being a standard part of the monetary culture. The modern-day mortgage entered being in 1934 when the governmentto assist the nation conquered the Great Depressioncreated a home mortgage program that decreased the needed deposit on a home, increasing the quantity prospective house owners might obtain.

Today, a 20% down payment is preferable, primarily because if your deposit is less than 20%, you are required to take out personal mortgage insurance (PMI), making your monthly payments greater. Desirable, nevertheless, is not necessarily achievable. how do down payments work on mortgages. There are home mortgage programs available that permit significantly lower down payments, but if you can handle that 20%, you absolutely should.

The Definitive Guide for How Fha Mortgages Work When You're The Seller

Size is the quantity of cash you borrow and the term is the length of time you have to pay it back. how do mortgages work in the us. Normally, the longer your term, the lower your regular monthly payment. That's why 30-year home loans are the most popular. Once you understand the size of the loan you require for your new house, a home loan calculator is an easy way to compare mortgage types and different lending institutions.

As we take a look at them, we'll utilize a $100,000 mortgage as an example. A portion of each home loan payment is devoted to payment of the primary balance. Loans are structured so the amount of primary returned to the customer starts low and increases with each home mortgage payment. The payments in the very first years are applied more to interest than principal, while the payments in the final years reverse that situation.

Interest is the lending institution's benefit for taking a risk and loaning you cash. The rate of interest on a home loan has a direct impact on the size of a home mortgage payment: Higher rates of interest mean higher home mortgage payments. Higher interest rates normally minimize the quantity of cash you can borrow, and lower rates of interest increase it.

The same loan with a 9% rates of interest outcomes in a month-to-month payment of $804.62. Property or real estate tax are examined by federal government companies and used to fund public services such as schools, police, and fire departments. Taxes are computed by the government on a per-year basis, however you can pay these taxes as part of your month-to-month payments.

How Do Arm Mortgages Work Things To Know Before You Get This

Here are 5 of the most common concerns and responses about home mortgage brokers. A home mortgage broker serves as a middleman between you and potential lenders. The broker's task is to deal with your behalf with several banks to find home loan loan providers with competitive rate of interest that finest fit your needs.

Home loan brokers are certified and regulated monetary experts. They do a great deal of the legwork from gathering documents from you to pulling your credit history and validating your earnings and work and use the information to get loans for you with several lenders in a short time frame."Mortgage brokers are licensed financial professionals.

Home mortgage brokers are usually paid by lenders, often by borrowers, but never both, says Rick Bettencourt, president of the National Association of Home Mortgage Brokers. Lender-paid compensation strategies pay brokers from 0. 50% to 2. 75% of the loan amount, he says. You can likewise select to pay the broker yourself.

"They might be the very same rate. However you need to do your due diligence [and look around]"The competitiveness and home prices in your regional market will have a hand in determining what brokers charge. The country's coastal areas, big cities and other markets with wesley sell high-value residential or commercial properties may have brokers charges as low as 0.

In the other instructions, however, federal law limitations how high payment can go."Under Dodd-Frank brokers aren't enabled to make more than 3% in points and costs," Bettencourt states. That limitation was taken into the monetary guideline law as an outcome of the predatory lending that activated the real estate crash. It initially applied to mortgages of $100,000 or more, though that limit has actually increased with inflation. how do mortgages payments work.

Home mortgage brokers, who work within a home loan brokerage firm or independently, offer with lots of lending institutions and make the bulk of their cash from lender-paid fees. A home loan broker looks for loans with various loan providers on your behalf, look for competitive home mortgage rates and negotiates terms. You can also save time by utilizing a home mortgage broker; it can take hours to look for various loans, then there's the back-and-forth communication associated with financing the loan and guaranteeing the deal stays on track.

How Bank Statement Mortgages Work Fundamentals Explained

But when selecting any loan provider broker, bank, online or otherwise you'll want to pay very close attention to lending institution fees. how do reverse mortgages work. Particularly, ask what charges will appear on page two of your Loan Price quote kind in the Loan Expenses section under "A: Origination Charges."Then, take the Loan Estimate you get from each lending institution, place them side by side and compare your interest rate and all of the charges and closing costs.

The best way is to ask good friends and relatives for recommendations, however make sure they have in fact used the broker and aren't simply dropping the name of a former college roommate or a distant associate. Find out all you can about the broker's services, communication style, level of knowledge and method to customers.

Ask your agent for the names of a couple of brokers that she or he has worked with and trusts. Some real estate business offer an in-house mortgage broker as part of their suite of services, but you're not obligated to choose that company or person. Finding the best home loan broker is similar to choosing the very best mortgage lender: It's smart to talk to a minimum of 3 individuals to learn what services they provide, just how much experience they have and how they can assist simplify the process.

Likewise, read online evaluations and consult the Better Business Bureau to evaluate whether the broker you're thinking about has a sound reputation. NerdWallet author Hal M. Bundrick added to this post. A previous version of this article misstated the contracts some brokers might have with lenders and how brokers are compensated.

Mortgage officers help customers discover appropriate home loan products. They normally work for banks and other loan provider. Home loan officers gather clients' financial info (e. g. taxes, debts) to examine if they are eligible for approving mortgage. They total mortgage loan applications based on nationwide and regional financial standards and examine their development.

When crafting your own mortgage officer task description, make sure to customize it to your requirements. We are trying to find an experienced home mortgage loan officer to join our team. You'll work closely with our customers and find the very best home mortgage loans for them. You'll estimate creditworthiness by combining information from customer interviews and financial files.

Little Known Facts About How Do Reverse Annuity Mortgages Work.

To be successful in this function, it is very important to be client-oriented and have strong analytical abilities. A degree in Financing or Business is a plus. If you're also reputable, sincere and have excellent judgment, we 'd like to meet you. Collect monetary information (e. g. taxes, financial obligations) Evaluate creditworthiness and eligibility for acquiring a home loan Interview clients Guide customers through mortgage alternatives Prepare and send home mortgage loan applications Ensure data remain in line with nationwide and regional monetary guidelines Monitor and report on application processes Inform customers about loan approval or rejection Aid https://www.inhersight.com/companies/best/reviews/salary?_n=112289587 willpower issues with applications Research study brand-new mortgage loan policies Ensure compliance with privacy laws and privacy policies throughout the procedure Develop an encouraging recommendation network (e.

with clients, loan providers, realty agents) Experience as a home loan officer or in a comparable role Previous experience in sales or consumer assistance is an asset Working understanding of mortgage computer software application (e. g. Calyx Point) Capability to manage secret information Fantastic mathematical and analytical skills Attention to information Reliability and sincerity A legitimate license is a need to Degree in Finance or Company is a plus.

A home mortgage is an agreement that permits a customer to use residential or commercial property as collateral to secure a loan. The term refers to a house loan in most cases. You sign an arrangement with your loan provider when you obtain to buy your house, providing the lending institution the right to do something about it if you do not make your required payments.

The sales proceeds will then be used to pay off any financial obligation you still owe on the property. The terms "home mortgage" and "house loan" are typically used interchangeably. Technically, a mortgage is the agreement that makes your home mortgage possible. Realty is pricey. Many people do not have enough readily available cash on hand to purchase a home, so they make a deposit, ideally in the neighborhood of 20% or two, and they obtain the balance.

Lenders are just ready to offer you that much money if they have a way to lower their danger. They protect themselves by requiring you to utilize the property you're buying as security. You "promise" the residential or commercial property, which pledge is your home loan. The bank takes approval to put a lien against your home in the fine print of your contract, and this lien is what permits them to foreclose if essential.

Indicators on How Do Interest Only Mortgages Work Uk You Should Know

Here are 5 of the most common concerns and responses about home loan brokers. A home mortgage broker functions as a middleman in between you and prospective lenders. The broker's job is to deal with your behalf with numerous banks to discover mortgage lenders with competitive rate of interest that finest fit your requirements.

Mortgage brokers are certified and regulated financial professionals. They do a lot of the legwork from collecting files from you to pulling your credit report and confirming your earnings and employment and utilize the info to get loans for you with numerous lending institutions in a brief time frame."Mortgage brokers are certified monetary professionals.

Home loan brokers are most frequently paid by loan providers, in some cases by borrowers, however never ever both, states Rick Bettencourt, president of the National Association of Home Loan Brokers. Lender-paid compensation plans pay brokers from 0. 50% to 2. 75% of the loan quantity, he says. You can also select to pay the broker yourself.

"They could be the exact same rate. But you need to do your due diligence [and store around]"The competitiveness and home costs in your local market will have a hand in dictating what brokers charge. The nation's seaside areas, big cities and other markets with high-value properties may have brokers costs as low as 0.

In the other direction, however, federal law limitations how high settlement can go."Under Dodd-Frank brokers aren't enabled to make more than 3% in points and charges," Bettencourt says. That constraint was taken into the monetary policy law as a result of the predatory loaning that set off the real estate crash. It originally used to home mortgages of $100,000 or more, though that limit has increased with inflation. how do escrow accounts work for mortgages.

Mortgage brokers, who work within a home mortgage brokerage firm or independently, deal with many loan providers and earn the bulk of their money from lender-paid fees. A home loan broker makes an application for loans with different lenders in your place, buy competitive https://www.inhersight.com/companies/best/reviews/salary?_n=112289587 home mortgage rates and negotiates terms. You can likewise save time by utilizing a home loan broker; it can take hours to use for different loans, then there's the back-and-forth communication associated with underwriting the loan and ensuring the transaction remains on track.

A Biased View of How Do Referse Mortgages Work

But when choosing any loan provider broker, bank, online or otherwise you'll desire to pay attention to lending institution costs. how home mortgages work. Particularly, ask what costs will appear on page two of your Loan Quote form in the Loan Costs section under "A: Origination Charges."Then, take the Loan Quote you get from each loan provider, put them side by side and compare your rate of interest and all of the fees and closing expenses.

The very best method is to ask buddies and family members for referrals, but ensure they have in fact used the broker and aren't just dropping the name of a previous college roomie or a far-off associate. Discover all you can about the broker's services, communication style, level of knowledge and technique to customers.

Ask your representative for the names of a few brokers that he or she has dealt with and trusts. Some realty business provide an internal mortgage broker as part of their suite of services, but you're not bound to opt for that business or person. Discovering the right home mortgage broker is much like picking the best home mortgage lending institution: It's a good idea to speak with a minimum of three people to learn what services they provide, how much experience they have and how they can assist streamline the procedure.

Likewise, read online reviews and inspect with the Bbb to examine whether the broker you're thinking about has a sound track record. NerdWallet writer Hal M. Bundrick contributed to this short article. A previous variation of this article misstated the arrangements some brokers may have with lenders and how brokers are compensated.

Mortgage loan officers help customers discover appropriate mortgage items. They normally work for banks and other loaning organizations. Home loan officers collect clients' financial info (e. g. taxes, debts) to review if they are qualified for approving mortgage. They total home loan applications based upon nationwide and regional financial requirements and examine their development.

When crafting your own home loan officer task description, make certain to tailor it to your requirements. We are looking for a knowledgeable mortgage officer to join our team. You'll work closely with our customers and discover the finest home loan for them. You'll estimate credit reliability by integrating info from client interviews and financial files.

The Best Guide To How Do Reverse Mortgages Work wesley sell In Nebraska

To succeed in this role, it is necessary to be client-oriented and have strong analytical abilities. A degree in Finance or Organization is a plus. If you're likewise dependable, honest and have good judgment, we wish to fulfill you. Collect monetary details (e. g. taxes, debts) Evaluate credit reliability and eligibility for getting a home loan Interview customers Guide customers through mortgage choices Prepare and send mortgage applications Guarantee data are in line with national and local financial rules Monitor and report on application procedures Inform customers about loan approval or rejection Aid resolve problems with applications Research study brand-new home loan policies Guarantee compliance with personal privacy laws and privacy policies throughout the procedure Construct a helpful referral network (e.

with customers, lending institutions, property agents) Experience as a mortgage officer or in a similar function Previous experience in sales or consumer assistance is an asset Working understanding of home loan computer system software (e. g. Calyx Point) Ability to deal with secret information Excellent mathematical and analytical abilities Attention to information Reliability and honesty A legitimate license is a must Degree in Financing or Service is a plus.

A mortgage is an arrangement that enables a customer to use property as collateral to protect a loan. The term refers to a mortgage in a lot of cases. You sign an arrangement with your loan provider when you obtain to buy your house, giving the loan provider the right to act if you don't make your required payments.

The sales earnings will then be utilized to pay off any debt you still owe on the property. The terms "home mortgage" and "home mortgage" are often used interchangeably. Technically, a mortgage is the contract that makes your home loan possible. Genuine estate is costly. Many people don't have adequate available money on hand to purchase a home, so they make a deposit, preferably in the area of 20% or so, and they borrow the balance.

Lenders are only going to offer you that much cash if they have a way to reduce their risk. They protect themselves by requiring you to use the residential or commercial property you're purchasing as security. You "pledge" the property, which promise is your home mortgage. The bank takes authorization to position a lien against your home in the small print of your contract, and this lien is what allows them to foreclose if necessary.

How Do Conventional Mortgages Work for Beginners

Here are 5 of the most common concerns and answers about mortgage brokers. A mortgage broker acts as an intermediary in between you and possible lenders. The broker's task is to work on your behalf with several banks to discover home mortgage loan providers with competitive rates of interest that best fit your requirements.

Home loan brokers are licensed and regulated monetary professionals. They do a lot of the legwork from collecting files from you to pulling your credit report and verifying your earnings and employment and use the info to look for loans for you with a number of lenders in a brief time frame."Home mortgage brokers are licensed financial professionals.

Home loan brokers are most often paid by lenders, often by debtors, however never ever both, states Rick Bettencourt, president of the National Association of Home Mortgage Brokers. Lender-paid payment strategies pay brokers from 0. 50% to 2. 75% of the loan quantity, he says. You can likewise pick to pay the broker yourself.

"They could be the same rate. However you need to do your due diligence [and store around]"The competitiveness and house rates in your local market will have a hand in dictating what brokers charge. The nation's seaside areas, big cities and other markets with high-value residential or commercial properties may have brokers charges as low as 0.

In the other instructions, however, federal law limits how high compensation can go."Under Dodd-Frank brokers aren't allowed to make more than 3% in points and costs," Bettencourt says. That limitation was taken into the monetary policy law as an outcome of the predatory financing that set off the real estate crash. It originally applied to home loans of $100,000 or more, though that limit has risen with inflation. how do mortgages payments work.

Home loan brokers, who work within a mortgage brokerage company or separately, handle lots of loan providers and make the bulk of their cash from lender-paid charges. A mortgage broker applies for loans with various lending institutions in your place, look for competitive mortgage rates and negotiates terms. You can also save time by utilizing a home mortgage broker; it can take hours to request various loans, then there's the back-and-forth communication included in financing the loan and making sure the transaction remains on track.

More About How Does Bank Loan For Mortgages Work

However when selecting any loan provider broker, bank, online or otherwise you'll wish to pay attention to lender fees. how do muslim mortgages work. Particularly, ask what fees will appear on page 2 of your Loan Quote type in the Loan Expenses section under "A: Origination Charges."Then, take the Loan Quote you receive from each loan provider, put them side by side and compare your rate of interest and all of the costs and closing expenses.

The very best method is to https://www.inhersight.com/companies/best/reviews/salary?_n=112289587 ask friends and family members for recommendations, however make certain they have actually utilized the broker and aren't simply dropping the name of a previous college roomie or a remote acquaintance. Learn all you can about the broker's services, communication design, level of understanding and method to customers.

Ask your agent for the names of a couple of brokers that he or she has actually worked with and trusts. Some real estate business provide an internal home loan broker as part of their suite of services, but you're not obliged to choose that company or person. Discovering the ideal mortgage broker is simply like picking the very best home mortgage lending institution: It's smart to talk to a minimum of 3 people to learn what services they offer, how much experience they have and how they can help simplify the procedure.

Likewise, read online evaluations and consult the Better Service Bureau to assess whether the broker you're considering has a sound credibility. NerdWallet wesley sell author Hal M. Bundrick added to this short article. A previous variation of this post misstated the agreements some brokers might have with lending institutions and how brokers are compensated.

Home loan officers help clients discover suitable mortgage items. They generally work for banks and other financing institutions. Home loan officers collect customers' monetary info (e. g. taxes, debts) to review if they are eligible for giving mortgage. They complete mortgage loan applications based on national and local monetary standards and evaluate their progress.

When crafting your own home mortgage loan officer task description, make sure to customize it to your requirements. We are searching for a knowledgeable mortgage officer to join our team. You'll work closely with our clients and find the very best mortgage for them. You'll approximate credit reliability by integrating information from customer interviews and financial documents.

About How Does Noi Work With Mortgages

To be successful in this function, it is necessary to be client-oriented and have strong analytical abilities. A degree in Financing or Organization is a plus. If you're also dependable, sincere and have great judgment, we wish to meet you. Gather monetary information (e. g. taxes, debts) Examine creditworthiness and eligibility for obtaining a mortgage Interview clients Guide customers through home loan options Prepare and send mortgage loan applications Ensure information remain in line with national and local financial guidelines Monitor and report on application procedures Notify customers about loan approval or rejection Aid willpower problems with applications Research study new home loan policies Guarantee compliance with privacy laws and privacy policies throughout the process Develop a helpful referral network (e.

with customers, lending institutions, real estate agents) Experience as a mortgage loan officer or in a comparable function Previous experience in sales or client support is a possession Working understanding of home loan computer software (e. g. Calyx Point) Ability to manage secret information Terrific mathematical and analytical abilities Attention to detail Reliability and sincerity A valid license is a must Degree in Financing or Business is a plus.

A mortgage is a contract that allows a customer to utilize home as collateral to secure a loan. The term describes a home mortgage most of the times. You sign an agreement with your loan provider when you borrow to buy your home, giving the loan provider the right to do something about it if you do not make your required payments.

The sales proceeds will then be utilized to pay off any debt you still owe on the home. The terms "home loan" and "home mortgage" are typically utilized interchangeably. Technically, a mortgage is the agreement that makes your home mortgage possible. Property is costly. Most individuals do not have enough readily available money on hand to purchase a house, so they make a deposit, preferably in the community of 20% or so, and they borrow the balance.

Lenders are only ready to give you that much cash if they have a method to decrease their danger. They secure themselves by requiring you to utilize the property you're buying as security. You "pledge" the residential or commercial property, which pledge is your mortgage. The bank takes authorization to put a lien versus your house in the fine print of your agreement, and this lien is what allows them to foreclose if essential.

An Unbiased View of How Do Reverse Mortgages Really Work?

However after that, your rate of interest (and month-to-month payments) will adjust, normally once a year, approximately corresponding to existing interest rates. So if rates of interest soar, so do your monthly payments; if they drop, you'll pay less on mortgage payments. Home purchasers with lower credit report are best matched for a variable-rate mortgage. Rates may alter every https://www.inhersight.com/companies/best/size/medium 6 or 12 months, as set out by the arrangement. Another option is the hybrid ARM, which begins the contract on a fixed rate for a set amount of time (frequently set as 3 or 5 years) prior to switching to the variable rate. Option ARMs can get made complex but are a good option for individuals desiring to borrow more than conventional lending would offer.

While you can just borrow against the equity you've already developed, they can be an excellent alternative for funding home upgrades or accessing money in emergency situation situations. House equity loans tend to have a larger interest rate, although the smaller sized amounts involved open the door to shorter-term contracts. It runs alongside the standard mortgage agreement, however, indicating the payments throughout the period will feel greater than regular. what were the regulatory consequences of bundling mortgages.

They work in an extremely comparable way to other credit lines contracts however are made versus the equity of the residential or commercial property. A reverse home loan is a principle developed exclusively for senior residents and serves to use access to equity in the house through a loan. This can be helped with as a set lump payment or month-to-month payments, along with by means of a credit line.

The loan does not have to be paid back till the last debtor dies or moves from the house for one entire year. An interest-only loan can be thought of as a type of hybrid mortgage. It works on the concept of just paying off the interest for the opening duration of the mortgage (typically 1-3 years) before then changing to your conventional fixed-rate or variable repayments.

However, the short-term cushion will indicate that the future repayments are larger since you'll need to offset the lost time. After all, a 20-year home mortgage on a 3-year interest just strategy is practically a 17-year home mortgage as you won't have actually knocked anything off the loan contract till the start of the fourth year.

If you recognize with balloon vehicle loan, the payment structure operates in an extremely similar way when handling balloon home mortgages. Essentially, you pay a low cost (maybe even an interest-only payment) throughout of the mortgage agreement before clearing the complete balance on the last payment. This type of mortgage is normally a lot shorter, with 10 years being the most common duration.

All about How Many Mortgages In One Fannie Mae

However, those that are set to rapidly reach and sustain a position of higher income may select this route. Re-finance loans are another alternative that is open to house owners that are currently several years into their mortgage. They can be used to lower interest payments and change the period of the contract.

The new loan is used to pay off the initial home loan, basically closing that offer prior to opening the brand-new term arrangement. This can be used to upgrade your homeownership status to reflect altering life situations, or to change the lender. Refinancing can be very useful in times of economic difficulty, however homeowners need to do their research study to see the full image as it can be harmful in lots of situations.

Finding the best home mortgage is one of the most crucial monetary challenges that you'll deal with, and it's a procedure that begins with picking the ideal type of home mortgage for your situation. While you may think that the differences between different home mortgage items are small, the impact that they can have on your future is substantial.

The team of professionals at A and N Home mortgage, one of the very best home loan lenders in Chicago, will assist you look for a home loan and discover an arrangement that works best for you. A and N Home Loan Solutions Inc, a home loan banker in Chicago, IL supplies you with premium, including FHA mortgage, customized to fit your unique situation with a few of the most competitive rates in the nation.

What's the distinction between a repayment, interest-only, repaired and variable home loan? Find out here. (Likewise see: our guides & guidance on very first time purchasing, shared ownership, buy-to-let, https://www.bloomberg.com/press-releases/2019-08-06/wesley-financial-group-provides-nearly-6-million-in-timeshare-debt-relief-in-july and remortgaging.) Over the term of your home loan, every month, you steadily pay back the cash you have actually borrowed, in addition to interest on nevertheless much capital you have left.

The amount of cash you have actually delegated pay is likewise called 'the capital', which is why repayment home loans are also called capital and interest home loans. Over the term of your loan, you do not really settle any of the home loan just the interest on it. Your month-to-month payments will be lower, however will not make a dent in the loan itself.

What Is The Maximum Number Of Mortgages for Dummies

Generally, individuals with an interest just home mortgage will invest their home mortgage, which they'll then utilize to pay the mortgage off at the end of the term. 'Rate' describes your rate of interest. With a fixed rate home mortgage, your lender warranties your interest rate will remain the exact same for a set amount of time (the 'preliminary period' of your loan), which is typically anything between 110 years.

SVR is a loan provider's default, bog-standard interest rate no offers, bells or whistles attached. Each lender is totally free to set their own SVR, and adjust it how and when they like. Technically, there isn't a home mortgage called an 'SVR home mortgage' it's just what you might call a mortgage out of a deal period.

Over a set time period, you get a discount rate on the loan provider's SVR. This is a kind of variable rate, so the quantity you pay every month can alter if the loan provider changes their SVR, which they're free to do as they like. Tracker rates are a type of variable rate, which indicates you could pay a different total up to your lending institution each month.

If the base rate increases or down, so does your interest rate. These are variable mortgages, however with a cap on how high the rate of interest can rise. Usually, the rates of interest is greater than a tracker mortgage so you might wind up paying additional for that comfort.

The Best Strategy To Use For How Reverse Mortgages Work

However after that, your rate of interest (and monthly payments) will adjust, generally when a year, roughly representing present rates of interest. So if interest rates shoot up, so do your monthly payments; if they drop, you'll pay less on mortgage payments. Home purchasers with lower credit ratings are best matched for an adjustable-rate home loan. Rates might alter every 6 or 12 months, as set out by the contract. Another alternative is the hybrid ARM, which begins the contract on a fixed rate for a set amount of time (often set as 3 or 5 years) before changing to the variable rate. Alternative ARMs can get complicated however are a great choice for people wishing to obtain more than conventional financing would offer.

While you can only obtain against the equity you've already built, they can be a great option for financing home upgrades or accessing cash in emergency circumstances. House equity loans tend to have a bigger rates of interest, although the smaller amounts included open the door to shorter-term arrangements. It runs alongside the standard home mortgage agreement, however, implying the payments throughout the period will feel higher than regular. how do mortgages work with married couples varying credit score.

They work in a very similar way to other lines of credit agreements but are made against the equity of the residential or commercial property. A reverse home mortgage is an idea developed exclusively for seniors and serves to use access to equity in the house through a loan. This can be assisted in as a set lump payment or month-to-month payments, in addition to via a credit line.

The loan does not have actually to be repaid till the last debtor dies or moves from the home for one whole year. An interest-only loan can be believed of as a type of hybrid home loan. It works on the principle of merely settling the interest for the opening period of the mortgage (often 1-3 years) prior to then changing to your standard fixed-rate or variable repayments.

Nevertheless, the short-term cushion will indicate that the future payments are larger since you'll have to offset the wasted time. After all, a 20-year home loan on a 3-year interest just strategy is almost a 17-year home mortgage as you won't have knocked anything off the loan contract until the start of the fourth year.

If you are familiar with balloon automobile loans, the payment structure works in a very similar manner when handling balloon home loans. Basically, you pay a low charge (possibly even an interest-only payment) throughout of the mortgage agreement before clearing the full balance on the final payment. This kind of home mortgage is normally a lot much shorter, with 10 years being the most typical duration.

Why Do Holders Of Mortgages Make Customers Pay Tax And Insurance for Beginners

Nevertheless, those that are set to quickly reach and sustain a position of higher profits may go with this route. Refinance loans are another option that is open to homeowners that are already several years into their home loan. They can be utilized to minimize interest payments and change the duration of the agreement.

The new loan is utilized to pay off the original home mortgage, essentially closing that deal prior to opening the brand-new term agreement. https://www.bloomberg.com/press-releases/2019-08-06/wesley-financial-group-provides-nearly-6-million-in-timeshare-debt-relief-in-july This can be utilized to update your homeownership status to reflect changing life situations, or to change the lender. Refinancing can be extremely helpful in times of economic challenge, however property owners require to do their research to see the full picture as it can be damaging in lots of circumstances.

Finding the ideal home loan is among the most crucial financial difficulties that you'll face, and it's a procedure that begins with picking the ideal type of home loan for your circumstance. While you might believe that the variances between different home loan items are little, the effect that they can have on your future is big.

The team of professionals at A and N Home mortgage, among the finest mortgage lenders in Chicago, will help you request a house loan and find a plan that works finest for you. A and N Home Mortgage Providers Inc, a home mortgage lender in Chicago, IL supplies you with top quality, consisting of FHA mortgage, tailored to fit your unique situation with some of the most competitive rates in the nation.

What's the difference in between a payment, interest-only, fixed and variable home loan? Learn here. (Also see: our guides & advice on very first time purchasing, shared ownership, buy-to-let, and remortgaging.) Over the term of your home loan, monthly, you steadily repay the money you have actually obtained, along with interest on nevertheless much capital you have left.

The quantity of cash you have delegated pay is also called 'the capital', which is why repayment mortgages are likewise called capital and interest home mortgages. Over the term of your loan, you don't actually settle any of the home mortgage simply the interest on it. Your monthly payments will be lower, however won't make a damage in the loan itself.

Some Ideas on How Does Bank Know You Have Mutiple Fha Mortgages You Should Know

Typically, people with an interest just home mortgage will invest their home mortgage, which they'll then use to pay the home mortgage off at the end of the term. 'Rate' refers to your rates of interest. With a fixed rate mortgage, your lending institution assurances your rates of interest will stay the exact same for a set quantity of time (the 'preliminary duration' of your loan), which is https://www.inhersight.com/companies/best/size/medium normally anything between 110 years.

SVR is a lender's default, bog-standard rates of interest no offers, bells or whistles connected. Each lender is free to set their own SVR, and change it how and when they like. Technically, there isn't a home loan called an 'SVR mortgage' it's just what you might call a mortgage out of an offer duration.

Over a set amount of time, you get a discount on the lending institution's SVR. This is a type of variable rate, so the amount you pay each month can change if the lender modifications their SVR, which they're totally free to do as they like. Tracker rates are a type of variable rate, which indicates you might pay a various total up to your lending institution each month.

If the base rate increases or down, so does your interest rate. These are variable mortgages, but with a cap on how high the rate of interest can increase. Usually, the rates of interest is greater than a tracker mortgage so you may wind up paying additional for that peace of mind.

The Main Principles Of How Do Home Mortgages Work

But after that, your rate of interest (and month-to-month payments) will adjust, typically when a year, roughly representing current rates of interest. So if rate of interest soar, so do your month-to-month payments; if they plummet, you'll pay less on home mortgage payments. Home purchasers with lower credit history are best fit for an adjustable-rate home mortgage. Rates might change every 6 or 12 months, as set out by the contract. Another alternative is the hybrid ARM, which starts the contract on a fixed rate for a set period of time (often set as 3 or 5 years) prior to changing to the variable rate. Option ARMs can get complicated but are a good option for individuals wanting to obtain more than conventional lending would offer.

While you can just obtain against the equity you've currently constructed, they can be an excellent choice for financing home upgrades or accessing money in emergency scenarios. Home equity loans tend to have a bigger rates of interest, although the smaller sized amounts included open the door to shorter-term contracts. It runs alongside the standard home mortgage arrangement, though, indicating the payments throughout the period will feel higher https://www.bloomberg.com/press-releases/2019-08-06/wesley-financial-group-provides-nearly-6-million-in-timeshare-debt-relief-in-july than regular. how much is mortgage tax in nyc for mortgages over 500000:oo.

They operate in a very similar manner to other lines of credit agreements but are made against the equity of the property. A reverse mortgage is a concept built specifically for elderly people and serves to offer access to equity in the house via a loan. This can be helped with as a set lump payment or month-to-month payments, along with via a credit line.

The loan does not need to be paid back up until the last customer dies or moves from the home for one entire year. An interest-only loan can be considered a type of hybrid home mortgage. It deals with the principle of merely settling the interest for the opening period of the home loan (frequently 1-3 years) prior to then changing to your traditional fixed-rate or variable repayments.

However, the short-term cushion will mean that the future payments are bigger due to the fact that you'll have to offset the wasted time. After all, a 20-year mortgage on a 3-year interest https://www.inhersight.com/companies/best/size/medium only strategy is virtually a 17-year home loan as you will not have actually knocked anything off the loan arrangement until the start of the fourth year.

If you recognize with balloon auto loan, the payment structure operates in an extremely similar way when handling balloon home mortgages. Essentially, you pay a low fee (possibly even an interest-only repayment) throughout of the home loan agreement before clearing the complete balance on the final payment. This type of mortgage is generally a lot shorter, with ten years being the most typical duration.

Not known Details About How To Add Dishcarge Of Mortgages On A Resume

However, those that are set to rapidly reach and sustain a position of greater income may select this route. Re-finance loans are another alternative that is open to property owners that are currently several years into their mortgage. They can be used to decrease interest payments and alter the duration of the contract.

The brand-new loan is used to settle the initial mortgage, basically closing that offer prior to opening the brand-new term arrangement. This can be used to update your homeownership status to reflect changing life circumstances, or to alter the lender. Refinancing can be really beneficial in times of financial challenge, however property owners need to do their research to see the complete image as it can be damaging in many situations.

Finding the right home loan is among the most crucial monetary obstacles that you'll deal with, and it's a process that starts with selecting the ideal kind of home loan for your circumstance. While you may think that the variations in between different mortgage items are little, the effect that they can have on your future is substantial.

The team of specialists at A and N Home loan, one of the finest home loan loan providers in Chicago, will help you request a mortgage and find a plan that works best for you. A and N Home Loan Solutions Inc, a home mortgage banker in Chicago, IL supplies you with premium, consisting of FHA home mortgage, tailored to fit your unique circumstance with some of the most competitive rates in the country.

What's the distinction between a payment, interest-only, repaired and variable home mortgage? Discover here. (Also see: our guides & suggestions on very first time buying, shared ownership, buy-to-let, and remortgaging.) Over the term of your home loan, every month, you progressively repay the cash you've obtained, along with interest on however much capital you have left.

The quantity of money you have delegated pay is likewise called 'the capital', which is why repayment home mortgages are also called capital and interest mortgages. Over the regard to your loan, you do not in fact pay off any of the home mortgage simply the interest on it. Your monthly payments will be lower, however won't make a damage in the loan itself.

All About How Do Adjustable Rate Mortgages React To Rising Rates

Normally, people with an interest only mortgage will invest their home loan, which they'll then use to pay the home mortgage off at the end of the term. 'Rate' describes your rates of interest. With a fixed rate home mortgage, your lending institution guarantees your interest rate will stay the exact same for a set quantity of time (the 'initial duration' of your loan), which is normally anything in between 110 years.

SVR is a lender's default, bog-standard rates of interest no offers, bells or whistles attached. Each lender is totally free to set their own SVR, and adjust it how and when they like. Technically, there isn't a mortgage called an 'SVR home mortgage' it's just what you could call a mortgage out of a deal period.

Over a set period of time, you get a discount rate on the lender's SVR. This is a kind of variable rate, so the amount you pay each month can change if the loan provider changes their SVR, which they're complimentary to do as they like. Tracker rates are a type of variable rate, which means you could pay a various total up to your lender monthly.

If the base rate goes up or down, so does your interest rate. These are variable home loans, however with a cap on how high the interest rate can increase. Typically, the rate of interest is higher than a tracker home loan so you might wind up paying additional for that peace of mind.

The 10-Minute Rule for How Do Reverse Mortgages Work

The amount a house owner can obtain, understood as the principal limit, varies based on the age of the youngest customer or qualified non-borrowing partner, present rates of interest, the HECM home loan limit ($ 765,600 as of July 2020) and the home's value. Property owners are likely to receive a higher primary limit the older they are, the more the residential or commercial property deserves and the lower the interest rate.

With a variable rate, your alternatives include: Equal month-to-month payments, offered at least one debtor lives in the property as their main house Equal monthly payments for a fixed period of months settled on ahead of time A credit line that can be accessed until it runs out A combination of a line of credit and repaired monthly payments for as long as you live in the house A combination of a credit line plus repaired month-to-month payments for a set length of time If you choose a HECM with a fixed interest rate, on the other hand, you'll receive a single-disbursement, lump-sum payment.

The quantity of cash you can get from a reverse home loan relies on a variety of elements, according to Boies, such as the present market price of your house, your age, present interest rates, the kind of reverse mortgage, its associated expenses and your financial assessment. The amount you receive will also be impacted if the house timeshare lawyers florida has any other home mortgages or liens.

" Instead, you'll get a portion of that worth." The closing expenses for a reverse home mortgage aren't cheap, but most of HECM home mortgages permit property owners to roll the costs into the loan so you don't have to pay out the cash upfront. Doing this, nevertheless, lowers the quantity of funds readily available to you through the loan.

See This Report on How Do Bad Credit Mortgages Work

5 percent of the outstanding loan balance. The MIP can be funded into the loan. To process your HECM loan, lending institutions charge the greater of $2,500 or 2 percent of the first $200,000 of your home's value, plus 1 percent of the amount over $200,000. The cost is topped at $6,000.

Month-to-month maintenance costs can not exceed $30 for loans with a fixed rate or a yearly changing rate, or $35 if the rate adjusts monthly. Third parties might charge their own charges, too, such as for the appraisal and home assessment, a credit check, title search and title insurance coverage, or a recording charge.

Rates can differ depending upon the loan provider, your credit history and other factors. While borrowing against your house equity can maximize money for living expenses, the home loan insurance coverage premium and origination and servicing costs can accumulate. Here are the advantages and drawbacks of a reverse mortgage. Borrower doesn't need to make month-to-month payments towards their loan balance Proceeds can be used for living and health care expenditures, financial obligation repayment and other costs Funds can help borrowers enjoy their retirement Non-borrowing spouses not listed on the mortgage can remain in the home after the borrower passes away Borrowers dealing with foreclosure can use a reverse home mortgage to settle the existing mortgage, potentially stopping the foreclosure Debtor must keep the home and pay home taxes and house owners insurance A reverse home mortgage forces you to borrow versus the equity in your home, which might be a crucial source of retirement funds Charges and other closing costs can be high and will reduce the quantity of money that is offered If you're not offered on getting a reverse mortgage, you have options.

Both of these loans allow you to obtain versus the equity in your house, although lenders restrict the total up to 80 percent to 85 percent of your house's worth, and with a house equity loan, you'll need to make regular monthly payments. (With a HELOC, payments are needed when the draw period on the line of credit expires.) The closing expenses and rate of interest for home equity loans and HELOCs likewise tend to be significantly lower than what you'll discover with a reverse home mortgage.

The How Do Home Interest Mortgages Work Ideas

If you require assist with a necessary costs, consider contacting a regional help company (the Administration for Community Living can assist you discover one), which may be able to help with fuel payments, energy costs and needed house repairs (how do interest only mortgages work). If you're able and happy to move, offering your house and moving to a smaller sized, less costly one can provide you access to your existing home's equity.

If you have not settled your home mortgage yet, you could check out re-financing the loan to decrease your month-to-month payments and free up the distinction. Make certain to weigh the closing costs and the brand-new loan terms, however, to see how these will impact your finances in your retirement years.

A counselor can help outline the benefits and drawbacks of this type of loan, and how it may affect your successors after you die. When shopping around, choose what type of reverse mortgage fits your monetary goals best. Compare several lenders and uses based on loan terms and fees.

As you buy a loan and consider your options, be on the lookout for two of the most common reverse mortgage scams: Some contractors will try to persuade you to get a reverse home loan when touting home improvement services. The Department of Veterans Affairs (VA) doesn't provide reverse home loans, however you may see ads guaranteeing special offers for veterans, such as a fee-free reverse home mortgage to attract debtors.

The Single Strategy To Use For How Do First And Second Mortgages Work

If a private or business is pushing you to sign a contract, for example, it's likely a red flag. A reverse home mortgage can be a help to property owners looking for extra income during their retirement years, and many utilize the funds to supplement Social Security or other income, satisfy medical expenditures, spend for at home care and make home enhancements, Boies says. how do commercial mortgages work.

Plus, if the value of the house values and ends up being worth more than the reverse mortgage balance, you or your heirs may receive the distinction, Boies discusses. The opposite, nevertheless, can posture an issue: If the balance goes beyond the home's worth, you or your heirs may require to foreclose or otherwise provide ownership of the house back to the https://www.dandb.com/businessdirectory/wesleyfinancialgroupllc-franklin-tn-88682275.html lender - what are reverse mortgages and how do they work.

Relative who inherit the property will wish to pay very close attention to the information of what is essential to handle the loan balance when the borrower passes away." There are arrangements that allow family to acquire the home in those circumstances, however they should pay off the loan with their own money or receive a mortgage that will cover what is owed," McClary states.

" Listening from a star spokesperson or a sales agent without getting the truths from a trusted, independent resource can leave you with a significant monetary dedication that may not be best for your scenarios." To locate an FHA-approved lender or HUD-approved therapy firm, you can visit HUD's online locator or call HUD's Real estate Counseling Line at 800-569-4287.

What Is The Deficit In Mortgages - Questions

But after that, your rate of interest (and month-to-month payments) will change, typically once a year, roughly corresponding to current interest rates. So if interest rates shoot up, so do your monthly payments; if they plummet, you'll pay less on mortgage payments. House purchasers with lower credit rating are best matched for a variable-rate mortgage. Rates may alter every 6 or 12 months, as set out by the agreement. Another choice is the hybrid ARM, which begins the arrangement on a fixed rate for a set duration of time (frequently set as 3 or 5 years) prior to changing to the variable rate. Choice ARMs can get complicated however are a good option for people wishing to obtain more than traditional lending would provide.

While you can just obtain versus the equity you've currently developed, they can be a great option for funding home upgrades or accessing cash in emergency circumstances. House equity loans tend to have a larger rate of interest, although the smaller sized sums included open the door to shorter-term contracts. It runs together with the basic home mortgage arrangement, however, meaning the payments throughout the duration will feel greater than regular. what is the best rate for mortgages.

They work in an extremely comparable way to other lines of credit agreements however are made against the equity of the residential or commercial property. A reverse mortgage is an idea constructed exclusively for elderly people and serves to use access to equity in the home by means of a loan. This can be helped with as a set swelling payment or monthly repayments, along with via a line of credit.

The loan does not have to be paid back till the last customer passes away or moves from the home for one whole year. An interest-only loan can be considered a kind of hybrid home mortgage. It deals with the principle of simply paying off the interest for the opening duration of the home loan (frequently 1-3 years) prior to then changing to your conventional fixed-rate or variable repayments.

However, the short-term cushion will mean that the future payments are bigger because you'll need to make up for the lost time. After all, a 20-year home mortgage on a 3-year interest just plan is almost a 17-year mortgage as you won't have actually knocked anything off the loan agreement till the start of the fourth year.

If you recognize with balloon auto loan, the payment structure works in a really similar manner when dealing with balloon home mortgages. Essentially, you pay a low cost (perhaps even an interest-only repayment) throughout of the home mortgage contract prior to clearing the complete balance on the last payment. This type of mortgage is generally a lot shorter, with ten years being wesley billing the most common period.

What Are The Types Of Reverse Mortgages Things To Know Before You Buy

Nevertheless, those that are set to quickly reach and sustain a position of higher profits may decide for this route. Re-finance loans are another option that is open to house owners that are already a number of years into their home mortgage. They can be used to decrease interest payments and alter the duration of the agreement.

The new loan is utilized to settle the initial home mortgage, basically closing that offer before opening the brand-new term agreement. This can be utilized to upgrade your homeownership status to reflect changing life situations, or to alter the lender. Refinancing can be extremely helpful in times of financial challenge, however homeowners require to do their research study to see the full image as it can be destructive in numerous scenarios.

Finding the ideal mortgage is one of the most crucial financial obstacles that you'll face, and it's a procedure that begins with selecting the ideal type of home loan for your scenario. While you may believe that the differences between various mortgage items are small, the effect that they can have on your future is huge.

The team of experts at A and N Home mortgage, among the very best home mortgage lending institutions in Chicago, will help you use for a mortgage and discover a plan that works best for you. A and N Home Mortgage Solutions Inc, a home mortgage banker in Chicago, IL http://elliottzqzb171.theglensecret.com/indicators-on-who-is-specialty-services-for-home-mortgages-you-should-know supplies you with premium, consisting of FHA mortgage, customized to fit your unique circumstance with some of the most competitive rates in the country.

What's the difference in between a payment, interest-only, repaired and variable home loan? Learn here. (Likewise see: our guides & recommendations on very first Find more info time buying, shared ownership, buy-to-let, and remortgaging.) Over the term of your home loan, each month, you steadily pay back the money you have actually borrowed, together with interest on however much capital you have left.

The amount of cash you have actually delegated pay is also called 'the capital', which is why payment home mortgages are also called capital and interest home loans. Over the term of your loan, you do not actually pay off any of the home loan just the interest on it. Your monthly payments will be lower, but won't make a damage in the loan itself.

See This Report about How Much Is Mortgage Tax In Nyc For Mortgages Over 500000:oo

Usually, individuals with an interest only mortgage will invest their home loan, which they'll then use to pay the mortgage off at the end of the term. 'Rate' refers to your interest rate. With a fixed rate mortgage, your loan provider guarantees your rates of interest will remain the exact same for a set quantity of time (the 'initial period' of your loan), which is generally anything in between 110 years.

SVR is a lender's default, bog-standard interest rate no offers, bells or whistles attached. Each loan provider is totally free to set their own SVR, and adjust it how and when they like. Technically, there isn't a mortgage called an 'SVR home loan' it's just what you could call a home loan out of an offer duration.

Over a set time period, you get a discount rate on the loan provider's SVR. This is a kind of variable rate, so the quantity you pay each month can alter if the loan provider changes their SVR, which they're totally free to do as they like. Tracker rates are a type of variable rate, which means you could pay a different quantity to your lending institution every month.

If the base rate goes up or down, so does your rates of interest. These vary mortgages, however with a cap on how high the rates of interest can increase. Generally, the interest rate is greater than a tracker home mortgage so you may end up paying extra for that comfort.

About Who Has The Lowest Apr For Mortgages

Table of ContentsHow To Swap Houses With Mortgages for Beginners

This gets rid of the requirement for a down payment and likewise prevents the requirement for PMI (personal home loan insurance) requirements. There are programs that will assist you in getting and funding a mortgage. Check with your bank, city advancement workplace or a well-informed real estate agent to discover more. when to refinance mortgages. Many government-backed home mortgages been available in one https://www.inhersight.com/companies/best/reviews/salary?_n=112289587 of 3 kinds: The U.S.

The initial step to receive a VA loan is to obtain a certificate of eligibility, https://www.inhersight.com/companies/best/reviews/flexible-hours then send it with your latest discharge or separation release papers to a VA eligibility center. The FHA was produced to assist individuals get affordable real estate - why are reverse mortgages bad. FHA loans are really made by a lending organization, such as a bank, but the federal government guarantees the loan (how to sell mortgages).